Business Line of Credit

Quick Loans Direct provides a fast and efficient financing process based on your business performance rather than your personal credit score.

We’ve helped thousands of small businesses get business loans through our fully automated instant approval system.

Get a Line of Credit

With a business line of credit, you have continuous access to the capital you need for ongoing growth. Rather than a one time, fixed amount, a business line of credit allows you the freedom to take as little or as much financing you require at any given time. Additionally, interest is only accrued on the amount you choose to borrow. Similar to how individuals use their credit cards, once the amount borrowed is paid in full, or if you take only a portion of the maximum line of credit, you will still have credit available to you. This is in contrast to a fixed loan where you accept the entire amount and once it’s paid off the loan is closed.

Personalized. Simple. Quick. Efficient.

Quick Loans Direct believes that speed matters.

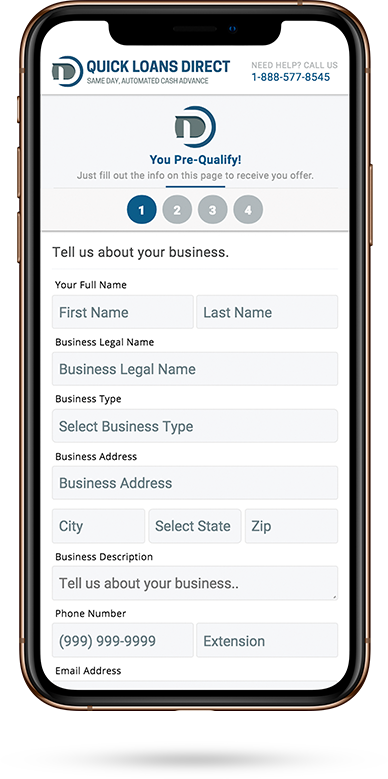

That’s why since 2015, Quick Loans Direct has built a model designed to get business the working capital they need in record time. When opportunity knocks the last thing a business owner wants to deal with are huge piles of paperwork and unrealistic timelines. Our seamless online application generated an instant pre-approval for a fast business loan in under 5 minutes. Funding can then happen within 4-24 hours.

Managing cash flow, maintaining or increasing inventory levels, and funding an unexpected expense are just a few examples of how small businesses can leverage the benefits and flexibility of a business line of credit.

Simply start the online application – takes about 5 minutes to complete

Simply start the online application – takes about 5 minutes to complete Upload 3 months of bank statements

Upload 3 months of bank statements Upon approval, complete an online check out and receive funds within a few hours

Upon approval, complete an online check out and receive funds within a few hours